DeFi yield farming strategies

Engaging in liquidity mining can also be a part of the yield farming approach.

Engaging in liquidity mining can also be a part of the yield farming approach.

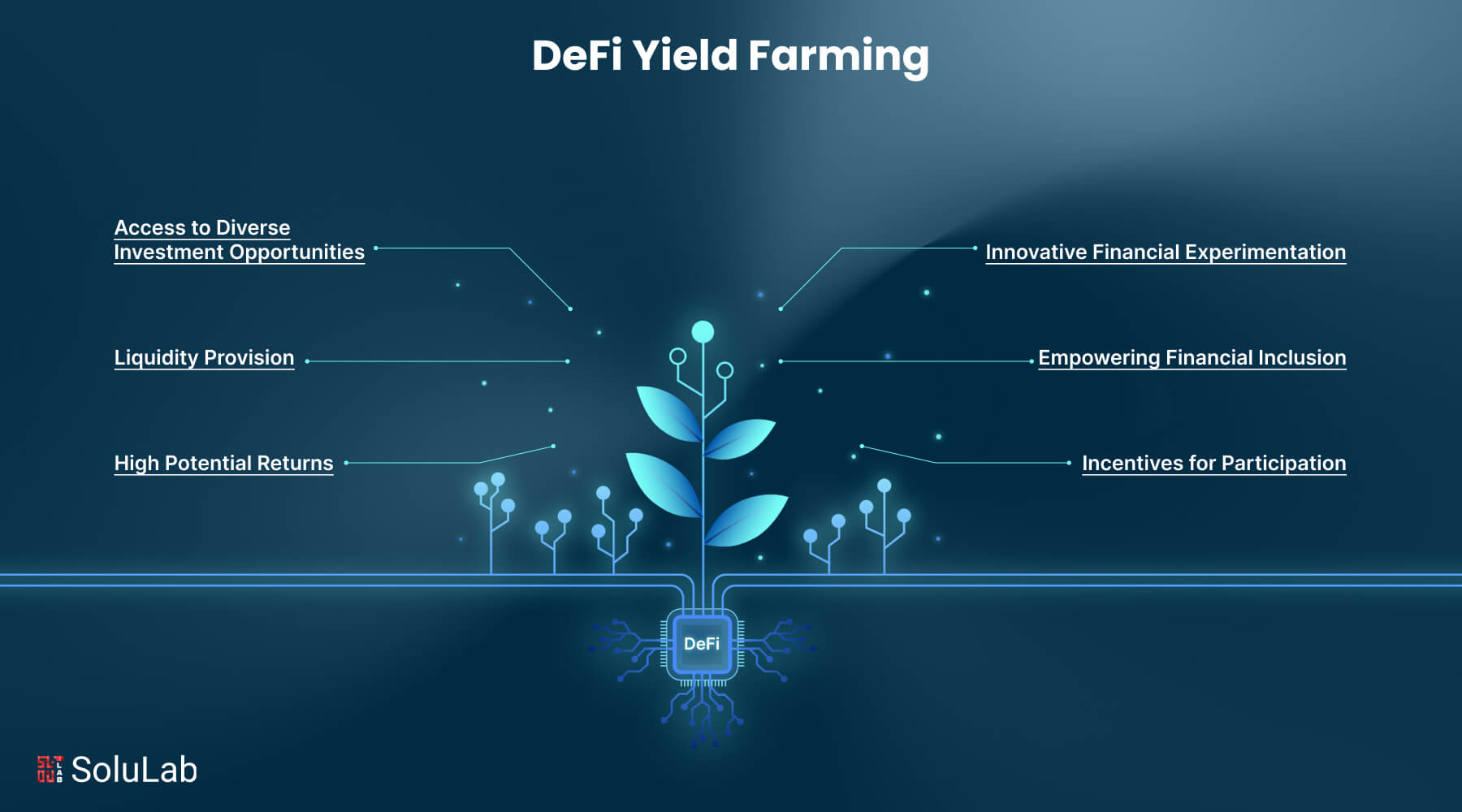

DeFi yield farming strategies aim to boost returns by engaging with decentralized finance protocols.

Liquidity provision in AMM pools like Uniswap and Curve is central to this strategy.

Yield farmers compound rewards by staking LP tokens in protocols offering governance tokens.

Diversification includes lending on platforms such as Aave and Compound for interest earnings.

Engaging in liquidity mining can also be a part of the yield farming approach.

However, risks are significant, including impermanent loss, smart contract vulnerabilities, and rug pulls.

DeFi yield farming strategies aim to boost returns by engaging with decentralized finance protocols.

Liquidity provision in AMM pools like Uniswap and Curve is central to this strategy.

Yield farmers compound rewards by staking LP tokens in protocols offering governance tokens.

Diversification includes lending on platforms such as Aave and Compound for interest earnings.

Sample text. Click to select the text box. Click again or double click to start editing the text.

Cups of coffee

Sample text. Click to select the text box. Click again or double click to start editing the text.

awards won

Sample text. Click to select the text box. Click again or double click to start editing the text.

happy clients

Sample text. Click to select the text box. Click again or double click to start editing the text.

projects finished

Sample text. Click to select the text box. Click again or double click to start editing the text.

However, risks are significant, including impermanent loss, smart contract vulnerabilities, and rug pulls.

DeFi yield farming strategies aim to boost returns by engaging with decentralized finance protocols.

1101 Outlet Collection Way, Auburn, WA 98001, US